I finally feel like a good trader: How I hit a 7-figure PnL in 2025

I can finally say I'm a profitable trader.

2025 was my first year where I felt consistent, confident, and—most importantly—like it wasn't luck. My PnL crossed welll over seven figures. More than all my previous years combined. The way I trade has changed completely, so here's what actually shifted.

The uncomfortable truth about technical analysis

I've been building a trading bot on the side. The bot wasn't involved in these trades, but working on it meant running millions of simulations and backtests. What I found confirmed something I'd long suspected: technical analysis is not a reliable way to make money trading.

The patterns people see on charts are mostly noise. The explanations come after the fact. I stopped wasting time on it entirely, and I think that's been a bigger contributor to my success than any single trade.

What actually changed

Three things are different now compared to when I was losing money:

I slowed way down. I used to stare at 5-minute and 15-minute charts. In 2025, I didn't look at anything below a 4-hour chart. Short timeframes trick you into seeing patterns that aren't there and making up explanations for random moves. Zooming out let me actually see things that were real.

I stopped treating positions as binary. I'm almost always in a position now. Previously, I'd open a trade, watch charts all night with my gut wrenching, and exit too soon. But I'm never 100% certain or 0% certain about anything—so why would my position look that way? Now I scale in slowly, always keeping enough balance for two more double-ups, and adjust based on conviction. Simply buying more when it goes down and selling when it goes up accounts for a lot of the gains.

I always have a theory. This is the big one. Without a justification for why you're in a trade, you're going to panic sell constantly—exposing the fact that you're just gambling. When I look back at 2025, there were hundreds of individual trades, but to me they were really just two trades: one thesis on ETH, one on Monero. Everything else was just adjusting position size based on conviction.

The trade: Bybit

In early 2025, Bybit got hacked for $1.6 billion. Largest hack in crypto history.

What was strange: the market barely reacted. Bybit announced a bridge loan, I pulled my funds out without issues, and everyone seemed to move on. But $1.6 billion is a shit ton of money. I believed the market had underreacted—that the typical crash which normally happens immediately would instead play out slowly over time.

I think about trading like poker. If I'm making $100, other participants have to lose that $100. A great trade requires me to be right about something that more than half the money is wrong about. My bet was simple: the losses from this hack would show up as a general downtrend. I didn't know how low or when, but it was enough to start selling.

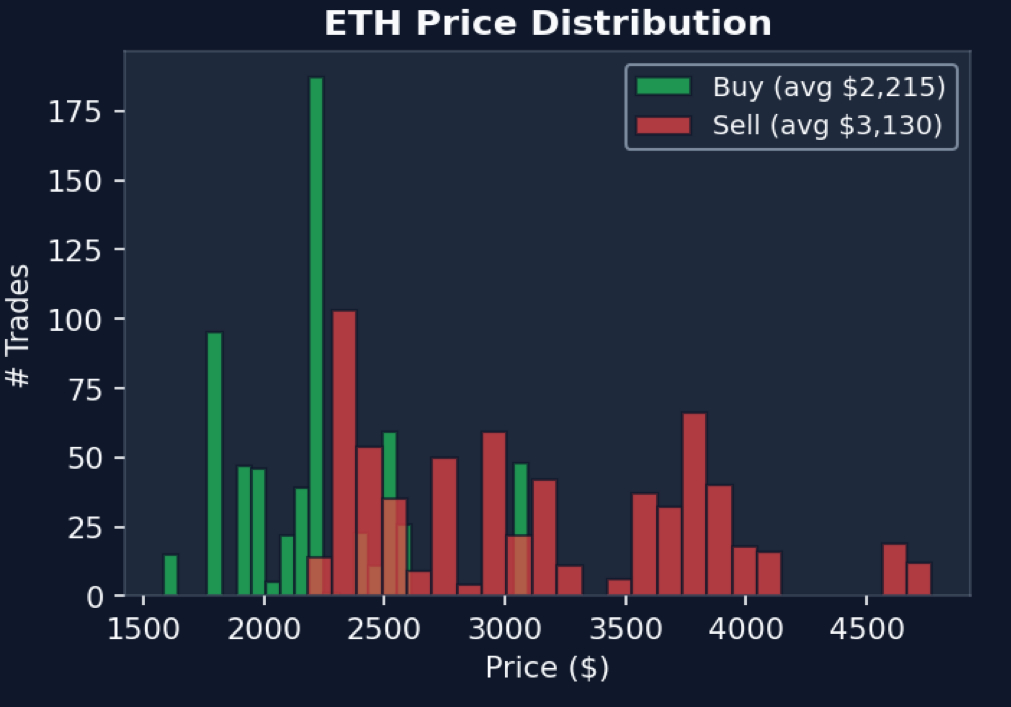

As prices came down, I scaled in. Most of my buys were around $2,200. At that point I was confident we'd hit bottom—confident enough to use leverage, though never past 3x. I always had resting orders to buy and sell simultaneously. I often started with a negative PnL (you can't perfectly time the bottom), but because of how I scaled in, by the time price returned to my initial entry, I was already in profit.

A few months in, I felt the reversal coming. Others seemed confused about why prices had dropped—which made sense if you hadn't connected it to the hack. To me, every move was expected. To most others, they were surprises. Being one cycle ahead makes all the difference.

The discipline that holds it together

When I'm trading well, I always have pre-decided actions for future scenarios. "If it dips sharp, buy X ETH at $Y." This eliminates emotional decisions and anxious chart-watching.

Generally: increase position on dips, reduce on sharp increases. Stay in a position always; only adjust exposure. You'd be surprised how much of a difference this makes.

What's next: Monero

Around June, I started getting interested in XMR.

I'm a heavy blockchain user—thousands of transactions over the years. I've become increasingly concerned about privacy and more careful about my on-chain footprint. This is why Bitcoin isn't even used on the dark web anymore; it's all moved to Monero.

That alone isn't enough to trade on. But then I looked at the market cap: roughly $5 billion. Bitcoin is over $1 trillion. I started thinking: Monero's got to be worth at least 5% of Bitcoin's market cap, right? That would put it at $50 billion—10x from here.

I'm a first adopter type. If I'm having these thoughts, I believe the majority will eventually. That's enough for me to make moves.

I'm still not fully scaled in, but we're seeing early signs. Monero went from a low of $200 to a high around $700 this year—and it's not even easy to buy. It's not on Coinbase, Binance, or Bybit. My first purchase was over a month after I wanted to buy, just because none of my exchanges supported it. Yet it still made these moves.

I predict that over the next year, as more exchanges list it, Monero will outperform both Bitcoin and Ethereum. We'll see.